Disparate systems. Manual processes. Large volumes of FTEs spread out globally.

Intercompany accounting is often inefficient due to its cross-functional nature involving Accounting, Tax, and Treasury. And most ERP systems are not designed to handle the complexity of the entire end-to-end intercompany process.

Now that businesses are being forced to close virtually, companies are looking for intercompany technology solutions that can bridge the gap of technology, business areas, and time zones to reduce risk and improve efficiency.

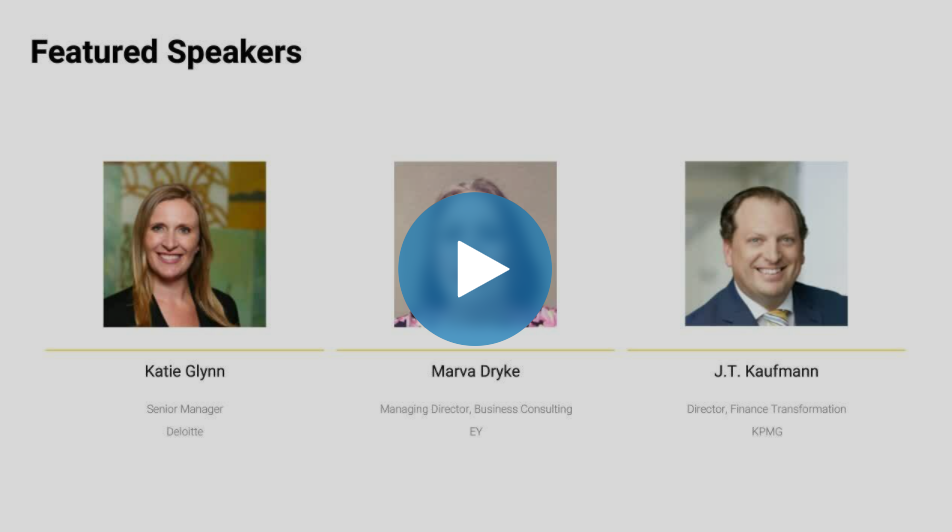

Join us for a conversation with Deloitte, EY, KPMG, and BlackLine on the topic of managing intercompany accounting in a virtual world.

We’ll bring together insights from specialists and your peers on ways to get control over your integrated processes.

Topics will include:

- Common risks and bottlenecks of managing a global intercompany process virtually

- Leading practices for intercompany governance

- How technology enablers can help reduce risk, save time, and boost global visibility in real time